There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

In the evolving world of financial services, institutions are constantly seeking smarter ways to understand and serve their clients. Salesforce Financial Services Cloud (FSC) introduces the Party Profile framework — a unified data model that organizes client information across individuals, households, and business entities. This model helps financial professionals gain a complete, 360-degree view of every relationship, ensuring data consistency and accuracy across all interactions. By centralizing information under the Party Profile, FSC empowers advisors, bankers, and insurers to deliver more personalized, compliant, and insight-driven client experiences.

What is a Party Profile in Salesforce FSC?

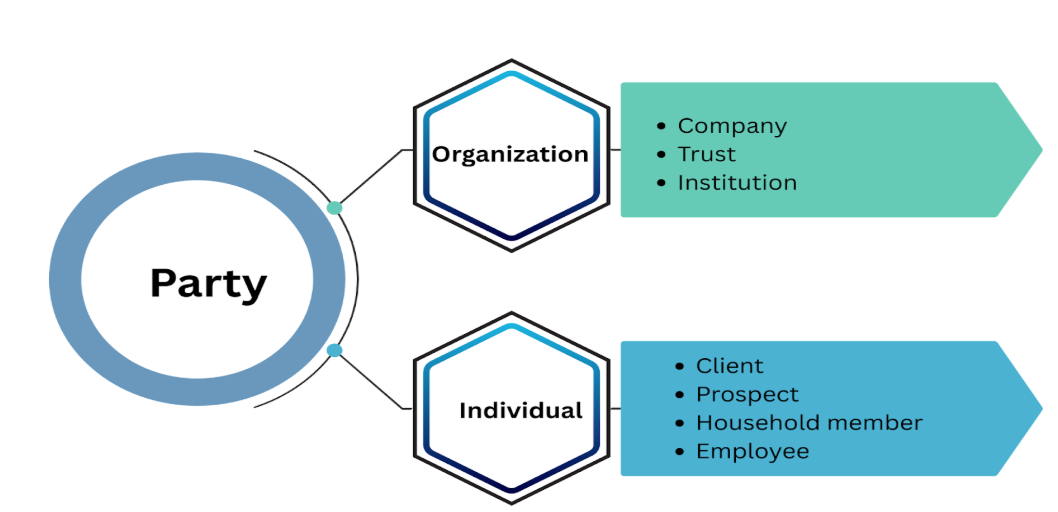

A Party Profile is a unified identity record that represents a person or organization in Financial Services Cloud (FSC). Instead of creating multiple separate records (like multiple Contacts or Accounts) for the same individual or business, FSC creates one core Party record and builds everything around it.

Each Party is assigned a unique Party ID, which acts like its digital identity.

A Party Profile in Salesforce FSC gives a complete 360° view of a person or organization. It includes:

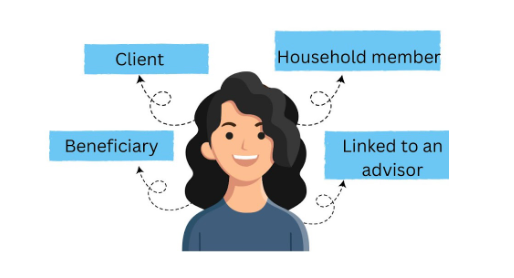

Let’s take Emma Johnson, She might be:

In FSC, Emma has ONE Party Profile, and all roles/relationships connect to it via the same Party ID.

The Party Profile model in Salesforce Financial Services Cloud represents a significant step forward in transforming client data management. It breaks traditional silos, enhances data integrity, and enables institutions to deliver more connected and intelligent experiences. Whether you are optimizing client onboarding, improving relationship tracking, or preparing for AI-driven insights, understanding and leveraging the Party Profile is key to unlocking the full potential of Financial Services Cloud.

At ForceArk Academy, we aim to help learners and professionals master these capabilities by empowering them to innovate and lead in the future of financial services.